- The stock market is sending a mixed signal to investors on who will win the presidential election, according to a note from LPL Research.

- A rising S&P 500 in the three months preceding the election favors Donald Trump to win re-election, while a surge in a basket of stocks including green energy names favors a Joe Biden win.

- “We think it’s going to be a lot closer than the polls may suggest right now, similar to what we saw in 2016,” LPL Chief Market Strategist Ryan Detrick said.

- Visit the Business Insider homepage for more stories.

The stock market has a knack for correctly predicting who will win the presidential election, but it’s sending mixed signals this time around.

Since 1984, the stock market correctly predicted the outcome of every presidential election based on the performance in the three months leading up to it. If the market was up in those three months, the incumbent party would win, and if the market was lower in those three months, the incumbent party would lose.

Since 1928, this methodology has correctly predicted which party would win the presidential election 87% of the time.

With Election Day less than one month away and early voting taking place in many states across the country, it remains an unknown whether President Trump or Joe Biden will win the election.

But with the S&P 500 up nearly 7% since August 3, the stock market is predicting that Trump will win re-election, LPL Research said in a note on Wednesday.

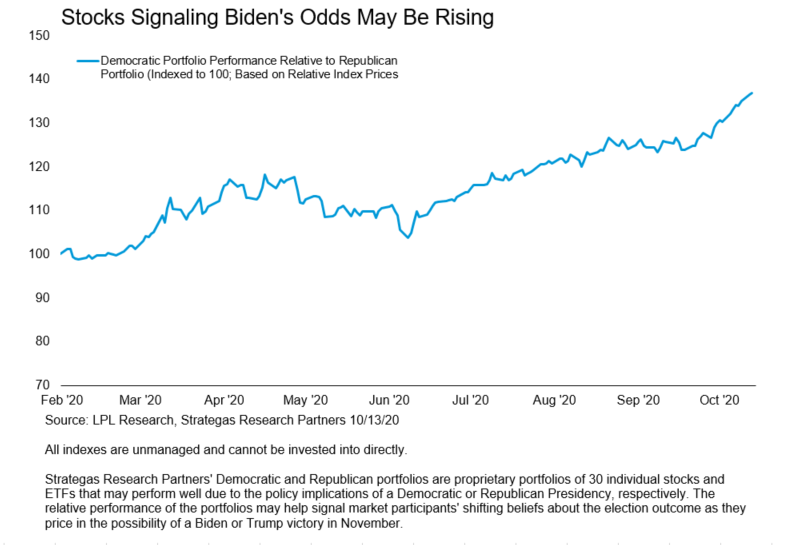

On the flipside, a basket of stocks known as the "Biden portfolio" has significantly outperformed its corresponding "Trump portfolio" year-to-date, suggesting that Biden will win the election, LPL highlighted.

The Trump and Biden portfolios were compiled by Strategas Research and are made up of stocks that investors view as likely to benefit from a Trump or Biden presidency, respectively.

The Biden portfolio has outperformed thanks to a surge in green energy stocks, which would likely benefit from Biden's renewable energy policy proposals.

So which election-predicting market indicator is right? Investors will know for sure after the election, but LPL Chief Market Strategist Ryan Detrick views the conflicting messages as a sign that the election will likely be a closer call than the polls are letting on.

"We think it's going to be a lot closer than the polls may suggest right now, similar to what we saw in 2016," Detrick said.

But regardless of who wins the election, investors should expect a continued economic rebound that "will support future equity gains," LPL said, adding that it's best to not make investment decisions based on the outcome of an election.

"In similarly polarizing elections in 2008 and 2016, investors who maintained their stock allocations were rewarded with future gains," LPL concluded.